Budgeting Tips to Avoid Tax Debt and Improve Finances

Learn practical budgeting tips that can help you avoid tax debt and significantly improve your overall financial situation.

Budgeting Tips to Avoid Tax Debt and Improve Finances

Hey there! Let's talk about something super important for your financial well-being: budgeting. Nobody wants to deal with tax debt, right? It's stressful, costly, and frankly, a pain. But guess what? A solid budget isn't just about cutting back; it's your secret weapon to not only steer clear of tax troubles but also to genuinely improve your entire financial picture. Think of it as your personal financial roadmap, guiding you to where you want to be.

Many people hear 'budget' and immediately think 'restriction' or 'boring math.' But that's not what we're going for here. A good budget is about understanding your money – where it comes from, where it goes, and how you can make it work harder for you. It's about gaining control, making informed decisions, and ultimately, building a more secure future. And a huge part of that security is making sure you're prepared for your tax obligations, rather than being caught off guard.

So, let's dive into some practical, actionable budgeting tips that can help you avoid tax debt and seriously boost your financial health. We'll cover everything from tracking your spending to choosing the right tools, and even how to make budgeting a habit you actually enjoy.

Understanding Your Income and Expenses The Foundation of Smart Budgeting

Before you can even think about cutting costs or saving, you need to know your starting point. This means getting a crystal-clear picture of your income and your expenses. It sounds simple, but you'd be surprised how many people don't truly know where their money goes each month.

Calculating Your Net Income What You Really Have to Work With

Your net income is the money that actually hits your bank account after taxes, deductions, and contributions (like 401k or health insurance) are taken out. This is your true spending power. Don't just look at your gross salary; focus on the net. If you're self-employed, this step is even more crucial. You need to estimate your income after setting aside money for self-employment taxes, health insurance, and any business expenses. A good rule of thumb for self-employed individuals is to set aside 25-35% of your gross income for taxes, depending on your income level and state taxes.

Tracking Your Spending Where Does All Your Money Go

This is often the most eye-opening part of budgeting. For at least a month, meticulously track every single dollar you spend. Yes, every coffee, every subscription, every grocery run. You can do this manually with a notebook, use a spreadsheet, or leverage budgeting apps (which we'll talk about soon). The goal here isn't to judge your spending, but to understand your habits. You might find that small, seemingly insignificant purchases add up to a significant amount over a month.

Categorize your expenses. Think about:

- Fixed Expenses: These are usually the same every month, like rent/mortgage, loan payments, insurance premiums, and some subscriptions.

- Variable Expenses: These fluctuate, such as groceries, utilities, entertainment, dining out, and transportation.

- Discretionary Expenses: These are non-essential items you can cut back on if needed, like new gadgets, vacations, or expensive hobbies.

Once you have this data, you can see exactly where your money is going. This insight is powerful because it allows you to identify areas where you might be overspending and where you can potentially reallocate funds towards savings or tax preparation.

Choosing the Right Budgeting Method Finding Your Financial Fit

There isn't a one-size-fits-all budget. What works for your friend might not work for you, and that's perfectly fine! The key is to find a method that you can stick with consistently. Here are a few popular ones:

The 50/30/20 Rule A Simple and Effective Approach

This is a fantastic starting point for many people because of its simplicity. It suggests dividing your after-tax income into three categories:

- 50% for Needs: This includes essentials like housing, utilities, groceries, transportation, and minimum loan payments.

- 30% for Wants: This covers discretionary spending like dining out, entertainment, hobbies, shopping, and vacations.

- 20% for Savings and Debt Repayment: This is crucial for building an emergency fund, retirement savings, and paying down any non-mortgage debt beyond the minimums. This 20% is also where you'd ideally set aside funds for future tax obligations if you're self-employed or expect to owe.

The beauty of the 50/30/20 rule is its flexibility. It gives you a framework without being overly restrictive, making it easier to adhere to long-term.

The Zero-Based Budget Every Dollar Has a Job

With a zero-based budget, you assign every single dollar of your income a specific job. This means your income minus your expenses (including savings and debt payments) should equal zero. It doesn't mean you have no money left; it means you've intentionally allocated every dollar. This method is great for people who want maximum control over their money and want to ensure no dollar is unaccounted for.

For example, if your net income is $4,000, you might allocate $1,500 for rent, $500 for groceries, $300 for utilities, $200 for transportation, $400 for entertainment, $600 for savings, and $500 for a tax savings fund. Everything adds up to $4,000. This method can be a bit more time-consuming initially but offers incredible clarity.

The Envelope System A Tangible Approach to Spending

This classic method involves using physical envelopes for different spending categories. At the beginning of the month, you put a set amount of cash into each envelope (e.g., 'Groceries,' 'Entertainment,' 'Dining Out'). Once an envelope is empty, you stop spending in that category until the next month. This is particularly effective for people who tend to overspend with credit cards or who benefit from a more tangible approach to money management. While it's traditionally cash-based, you can adapt it using separate bank accounts or digital 'envelopes' within budgeting apps.

Leveraging Budgeting Tools and Apps Modern Solutions for Financial Control

In today's digital age, there are countless tools to help you budget effectively. These can automate tracking, provide insights, and make the whole process much less daunting. Here are some popular options, including specific products, their use cases, comparisons, and pricing:

Personal Finance Software and Apps Top Picks for Budgeting and Tax Prep

These tools connect to your bank accounts and credit cards, automatically categorizing transactions and giving you a real-time view of your finances. They are invaluable for tracking spending, setting budgets, and often have features that can help with tax preparation by categorizing deductible expenses.

1. You Need A Budget YNAB The Zero-Based Budgeting Champion

- Use Case: YNAB is perfect for those who want to implement a strict zero-based budget. It forces you to give every dollar a job, which is incredibly effective for gaining control over your spending and saving for specific goals, including future tax payments. It's particularly strong for self-employed individuals who need to proactively set aside tax money.

- Features: Connects to bank accounts, real-time transaction tracking, goal setting, detailed reporting, mobile app, and a strong emphasis on its four rules (Give Every Dollar a Job, Embrace Your True Expenses, Roll with the Punches, Age Your Money).

- Comparison: More hands-on than some other apps, requiring active engagement. Its philosophy is its strength, but it might feel restrictive to some. It's less about just tracking and more about actively managing.

- Pricing: Typically around $14.99 per month or $99 per year. They often offer a free trial (e.g., 34 days).

2. Mint The Free All-in-One Financial Dashboard

- Use Case: Mint is excellent for beginners or anyone looking for a free, comprehensive overview of their finances. It's great for tracking spending, setting basic budgets, and monitoring net worth. It can help you see where you're spending and identify areas to cut back, which indirectly helps with tax planning by freeing up funds.

- Features: Connects to bank accounts, credit cards, investments, and loans. Automatic categorization, bill tracking, credit score monitoring, budget creation, and financial goal setting.

- Comparison: Free, which is a huge plus. It's more of a passive tracker and reporter compared to YNAB's active management style. While it offers budgeting, it doesn't enforce a specific method as strictly as YNAB.

- Pricing: Free (ad-supported).

3. Personal Capital For Investment-Focused Budgeting and Net Worth Tracking

- Use Case: While it has budgeting features, Personal Capital truly shines for individuals with investments who want to track their net worth, analyze their portfolio, and plan for retirement. Its budgeting features are more high-level, focusing on cash flow rather than granular expense tracking. It's useful for understanding your overall financial health, which includes your tax liabilities on investments.

- Features: Connects to all financial accounts (bank, credit, investment, mortgage), net worth tracker, investment analysis tools, retirement planner, fee analyzer, and basic cash flow budgeting.

- Comparison: Less focused on day-to-day budgeting than YNAB or Mint, but superior for investment tracking and long-term financial planning. It offers free tools, but also has paid advisory services.

- Pricing: Free for the basic tools. Paid advisory services start for portfolios over $100,000.

4. Simplifi by Quicken A Balanced Approach to Budgeting and Tracking

- Use Case: Simplifi is a good middle-ground option for those who want robust tracking and budgeting without the strictness of YNAB or the ad-supported nature of Mint. It's great for understanding your spending, creating custom budgets, and setting savings goals. It helps you identify surplus funds that can be allocated to tax savings.

- Features: Connects to all accounts, customizable spending plan, real-time cash flow, spending insights, watchlists for specific categories, and a clean user interface.

- Comparison: Offers a more modern interface than traditional Quicken desktop software. It's a paid service, offering more privacy than free, ad-supported apps. It strikes a balance between detailed tracking and ease of use.

- Pricing: Around $3.99 per month or $47.88 per year.

Spreadsheets The DIY Budgeting Powerhouse

For those who love control and customization, a good old spreadsheet (Google Sheets, Excel) can be incredibly powerful. You can design it exactly how you want, track specific categories relevant to your tax situation (e.g., business expenses, charitable donations), and perform complex calculations. Many free templates are available online to get you started.

- Use Case: Ideal for individuals or small businesses who prefer manual control, want highly customized categories, or need to track specific tax-deductible expenses meticulously.

- Features: Fully customizable, no subscription fees (if you use free software like Google Sheets), allows for complex formulas and detailed reporting.

- Comparison: Requires more manual input and setup than apps, but offers unparalleled flexibility. No automatic bank syncing, so you'll need to manually input transactions or import statements.

- Pricing: Free (with Google Sheets or basic Excel versions).

Practical Budgeting Strategies to Prevent Tax Debt

Now that you have your income and expenses mapped out and a budgeting method in mind, let's talk about specific strategies to ensure you're not caught off guard by tax season.

Automate Your Savings and Tax Fund Set It and Forget It

One of the most effective ways to save for anything, including taxes, is to automate it. Set up automatic transfers from your checking account to a dedicated savings account (or a separate 'tax fund' account) each payday. Even small, consistent transfers add up significantly over time. For self-employed individuals, this is non-negotiable. Calculate your estimated quarterly taxes and set up transfers to cover them well in advance.

Create a Dedicated Tax Savings Account Separate Your Funds

This is especially important for freelancers, gig workers, and small business owners. Open a separate savings account specifically for taxes. When you get paid, immediately transfer a percentage (e.g., 25-35%) of that income into this account. This prevents you from accidentally spending money that's earmarked for the IRS. It also makes quarterly estimated tax payments much less stressful.

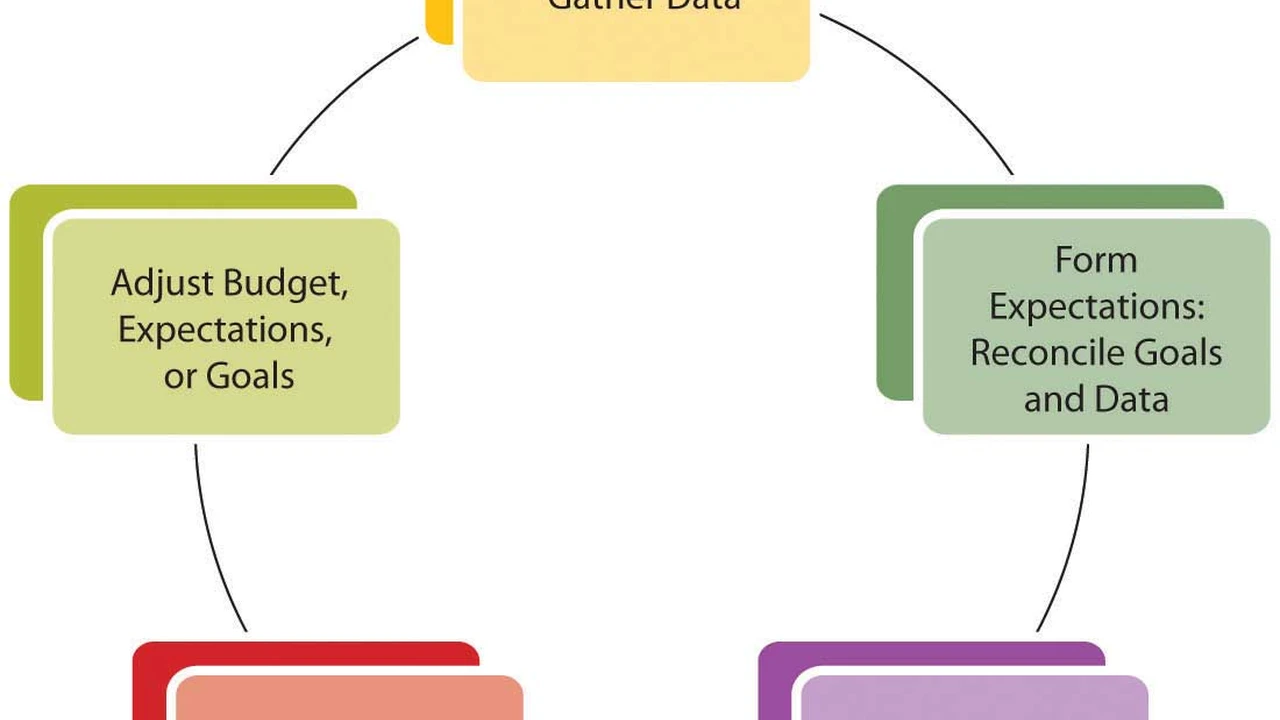

Review and Adjust Your Budget Regularly Stay Flexible

Your budget isn't a static document; it's a living tool. Life happens! Your income might change, your expenses might increase (hello, new baby!), or you might have new financial goals. Make it a habit to review your budget at least once a month. See what's working, what's not, and make adjustments as needed. This flexibility is key to long-term budgeting success.

Cut Unnecessary Expenses Free Up Cash for Taxes and Savings

Once you've tracked your spending, you'll likely identify areas where you can cut back without significantly impacting your quality of life. Maybe it's that streaming service you rarely use, or those daily lattes. Even small cuts can free up significant funds over a year. Reallocate these savings directly to your tax fund or emergency savings.

Consider a 'no-spend challenge' for a week or a month to really highlight where your money is going and how much you can save. It's a great way to reset your spending habits.

Build an Emergency Fund Your Financial Safety Net

An emergency fund is crucial for preventing debt, including tax debt. If an unexpected expense pops up (car repair, medical bill), you won't have to dip into money set aside for taxes or resort to high-interest credit cards. Aim for at least 3-6 months' worth of essential living expenses in an easily accessible savings account. This fund provides a buffer that can prevent a small financial hiccup from snowballing into a tax problem.

Plan for Large or Irregular Expenses Anticipate the Big Ones

Beyond your regular monthly bills, think about larger, less frequent expenses. This could be annual insurance premiums, car maintenance, holiday gifts, or even a planned vacation. Incorporate these into your budget by dividing the total cost by 12 and setting aside that amount each month. This way, when the expense comes due, the money is already there, and you're not scrambling or short-changing your tax savings.

Making Budgeting a Habit and Staying Motivated

The hardest part of budgeting isn't setting it up; it's sticking to it. Here are some tips to make it a sustainable habit:

Set Realistic Goals Small Wins Lead to Big Successes

Don't try to overhaul your entire financial life overnight. Start with small, achievable goals. Maybe it's tracking your spending for a month, or cutting back on one specific category. Celebrate these small wins! They build momentum and confidence, making it easier to tackle bigger financial challenges.

Find an Accountability Partner Share Your Journey

Sometimes, having someone else in your corner can make all the difference. This could be a spouse, a trusted friend, or even an online community. Share your financial goals and progress. Knowing someone else is aware of your efforts can provide extra motivation and support.

Educate Yourself Continuously Learn and Grow

The world of personal finance is always evolving. Stay informed about tax law changes, new savings strategies, and investment opportunities. The more you learn, the more empowered you'll feel to make smart financial decisions and avoid pitfalls like tax debt. Read financial blogs, listen to podcasts, or even take a personal finance course.

Be Kind to Yourself Budgeting Is a Journey Not a Destination

There will be months where you go over budget, or unexpected expenses throw you off track. Don't beat yourself up! The key is to learn from it, adjust your budget, and get back on track. Budgeting is an ongoing process, and perfection isn't the goal; progress is.

By implementing these budgeting tips and utilizing the right tools, you'll not only avoid the headache of tax debt but also build a stronger, more resilient financial foundation for your future. It's about taking control, making conscious choices, and enjoying the peace of mind that comes with financial stability. You got this!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)