Offer in Compromise vs Installment Agreement Which is Best

Compare Offer in Compromise and Installment Agreements to find the optimal IRS tax debt solution for your financial situation.

Offer in Compromise vs Installment Agreement Which is Best

Facing a significant tax debt can be incredibly stressful. The Internal Revenue Service (IRS) has various programs designed to help taxpayers resolve their outstanding obligations, and two of the most common and often discussed are the Offer in Compromise (OIC) and the Installment Agreement (IA). While both aim to help you settle your tax debt, they operate very differently and are suitable for distinct financial situations. Understanding the nuances of each can save you a lot of money and stress in the long run. This comprehensive guide will break down everything you need to know about OICs and IAs, helping you determine which path is best for you.

Understanding the Offer in Compromise OIC for Tax Debt Relief

An Offer in Compromise (OIC) is an agreement between a taxpayer and the IRS that settles a tax liability for less than the full amount owed. Think of it as a negotiation. The IRS will agree to an OIC only when it believes that the amount offered is the most it can expect to collect within a reasonable period. This program is generally for taxpayers who are experiencing significant financial hardship and cannot pay their full tax liability. It's not a quick fix, and the IRS has strict criteria for approval.

Types of Offer in Compromise OIC Eligibility and Criteria

The IRS considers three main reasons for accepting an OIC:

- Doubt as to Collectibility: This is the most common reason. It means the IRS believes you cannot pay the full amount of the tax liability. They will look at your ability to pay, your income, expenses, and asset equity.

- Doubt as to Liability: This means there's a genuine doubt that you owe the assessed tax debt. This is less common and usually involves a legal dispute over the tax itself, not just your ability to pay.

- Effective Tax Administration (ETA): This is for situations where there's no doubt you owe the tax and could pay it, but requiring full payment would cause significant economic hardship or would be unfair and inequitable. For example, if paying the full amount would leave you unable to afford basic living expenses or would severely impair your ability to earn a living.

How the IRS Calculates Your Reasonable Collection Potential RCP for OIC

When you submit an OIC, the IRS calculates your 'Reasonable Collection Potential' (RCP). This is the amount the IRS believes it could collect from you. The RCP is determined by looking at:

- Your ability to pay: This involves your current and future income, minus necessary living expenses. The IRS uses national and local standards for living expenses, which can be quite strict.

- Equity in assets: This includes the fair market value of your assets (like real estate, vehicles, bank accounts, investments) minus any secured debt on those assets.

- Future earning potential: The IRS will consider your potential to earn income in the future.

The offer you submit must generally be equal to or greater than your RCP. If your offer is too low, it will likely be rejected.

Pros and Cons of an Offer in Compromise OIC for Taxpayers

Pros:

- Significant Debt Reduction: The biggest advantage is the potential to settle your tax debt for a fraction of what you owe.

- Fresh Start: Once accepted and paid, your tax debt is resolved, offering a clean slate.

- Stops Collection Actions: While your OIC is being considered, the IRS generally stops collection activities like levies and garnishments.

Cons:

- Difficult to Qualify: OICs are not easy to get. The IRS rejects a significant percentage of applications.

- Lengthy Process: The application and review process can take many months, sometimes over a year.

- Financial Scrutiny: The IRS will conduct a thorough investigation into your finances, which can feel intrusive.

- Compliance Requirement: You must remain compliant with all tax filings and payments for five years after the OIC is accepted, or the OIC can be defaulted.

- Non-Refundable Application Fee: There's a non-refundable application fee (currently $205, though it can be waived for low-income taxpayers).

- Payment Requirement: You typically need to make an initial payment with your offer, or a series of payments during the review process, depending on the payment option you choose (lump sum or periodic).

Understanding the Installment Agreement IA for Managing Tax Debt

An Installment Agreement (IA) is a much simpler and more common way to resolve tax debt. It allows taxpayers to make monthly payments to the IRS over a set period, typically up to 72 months (6 years). Unlike an OIC, an IA doesn't reduce the amount of tax you owe; it simply provides a structured payment plan to pay off the full amount, plus penalties and interest.

Types of Installment Agreements IA Eligibility and Setup

There are a few types of Installment Agreements:

- Guaranteed Installment Agreement: If you owe $10,000 or less (not including penalties and interest), have filed all required returns, and can pay off the debt within three years, the IRS must grant you an IA if you request it.

- Streamlined Installment Agreement: This is available to individuals who owe up to $50,000 (including penalties and interest) or businesses that owe up to $25,000 (including penalties and interest). You can set this up online, over the phone, or by mail, and the IRS generally won't require a detailed financial statement. The payment period is typically up to 72 months.

- Non-Streamlined Installment Agreement: If you owe more than the streamlined limits, or if the IRS determines you can pay more than you're offering, you'll need to submit a detailed financial statement (Form 433-F or 433-A) for the IRS to review your ability to pay.

Pros and Cons of an Installment Agreement IA for Taxpayers

Pros:

- Easier to Obtain: Especially for streamlined agreements, IAs are much easier to qualify for than OICs.

- Predictable Payments: You'll have a clear, fixed monthly payment, making budgeting easier.

- Stops Collection Actions: Once an IA is approved, the IRS will generally stop collection actions like levies and garnishments.

- Less Financial Scrutiny: For streamlined agreements, the IRS doesn't require a detailed financial analysis.

- No Upfront Fee (for online setup): Setting up an IA online is free. There's a fee for phone or mail setup, but it's often lower than the OIC application fee.

Cons:

- No Debt Reduction: You still pay the full amount of tax owed, plus interest and penalties.

- Interest and Penalties Accrue: Interest and penalties continue to accrue on the outstanding balance until the debt is paid in full.

- Compliance Requirement: You must remain current with all future tax filings and payments. If you miss a payment or fail to file, the IA can be defaulted.

- Longer Payment Period: While it's a pro for some, paying over 72 months means you're dealing with the debt for a longer time.

Offer in Compromise vs Installment Agreement Key Differences and Comparison

Let's put them side-by-side to highlight the critical differences:

| Feature | Offer in Compromise (OIC) | Installment Agreement (IA) |

|---|---|---|

| Goal | Settle tax debt for less than the full amount | Pay full tax debt over time |

| Eligibility | Significant financial hardship, doubt as to collectibility/liability/ETA | Ability to pay full amount over time, within certain debt limits for streamlined options |

| Financial Scrutiny | High (detailed financial statements required) | Low (for streamlined), High (for non-streamlined) |

| Application Process | Complex, lengthy, requires Form 656 and financial forms | Simpler, can be done online/phone for streamlined, Form 9465 for others |

| Application Fee | $205 (can be waived for low-income) | $31 for online, $107 for phone/mail (can be waived for low-income) |

| Debt Reduction | Yes, potentially significant | No, full amount paid |

| Interest & Penalties | Stop accruing once OIC is accepted and paid | Continue to accrue until debt is paid in full |

| Compliance Period | 5 years after acceptance | Throughout the agreement term |

| Best For | Taxpayers with severe financial hardship and limited ability to pay | Taxpayers who can afford to pay their full debt but need more time |

When to Choose an Offer in Compromise OIC for Your Tax Situation

An OIC is typically the right choice if you meet these conditions:

- Severe Financial Hardship: You genuinely cannot afford to pay your full tax debt without sacrificing basic living necessities.

- Limited Assets: You have minimal equity in assets that the IRS could seize.

- Low Income Relative to Debt: Your income, after essential expenses, leaves little to no disposable income to pay down the debt.

- Long-Term Inability to Pay: You foresee that your financial situation won't significantly improve enough to pay the full debt within the collection statute of limitations.

- Willingness for Scrutiny: You are prepared for the IRS to thoroughly examine every aspect of your finances.

It's crucial to understand that the IRS wants to see that you've exhausted all other options and that your offer represents the maximum amount they could reasonably expect to collect. If you have significant assets or a high disposable income, an OIC is unlikely to be approved.

When to Opt for an Installment Agreement IA for Tax Debt Management

An IA is usually the better option if:

- You Can Afford to Pay: You have enough disposable income to make regular monthly payments that will pay off the debt within 72 months.

- You Need Time: You need more time than the standard payment due date to pay your full tax liability.

- You Want Simplicity: You prefer a straightforward payment plan with less financial scrutiny (especially for streamlined agreements).

- You Don't Qualify for OIC: Your financial situation doesn't meet the strict OIC criteria, but you still need a payment plan.

- You Want to Avoid Liens/Levies: An approved IA will prevent the IRS from taking aggressive collection actions.

Many taxpayers initially try to qualify for an OIC, but if they don't meet the strict criteria, an Installment Agreement becomes the next best, and often very effective, solution.

Hybrid Approaches and Other Considerations for Tax Debt Resolution

Sometimes, neither an OIC nor a standard IA is a perfect fit, or you might need to consider other options. It's not always an either/or situation.

Currently Not Collectible CNC Status for Extreme Hardship

If you are in extreme financial hardship and cannot even afford an Installment Agreement, the IRS might place your account in 'Currently Not Collectible' (CNC) status. This means the IRS agrees that you cannot pay any of your tax debt at this time. While in CNC status, the IRS will temporarily stop collection efforts. However, interest and penalties continue to accrue, and the IRS will periodically review your financial situation to see if it has improved. This is a temporary reprieve, not a permanent solution, and it doesn't reduce the amount you owe.

Short-Term Payment Plans for Temporary Relief

If you can pay your tax debt in full within 180 days, but just need a little more time, you can request a short-term payment plan. This is often easier to obtain than a full Installment Agreement, but interest and penalties still apply.

Tax Debt Relief Professionals When to Seek Expert Help

Navigating IRS tax debt can be complex, and making the wrong decision can have significant financial consequences. This is where tax debt relief professionals come in. They can assess your unique situation, help you understand your options, and represent you before the IRS. These professionals include:

- Tax Attorneys: Best for complex legal issues, appeals, or if you believe there's doubt as to liability. They can represent you in tax court.

- Enrolled Agents (EAs): Federally authorized tax practitioners who specialize in taxation and have unlimited practice rights before the IRS. They are excellent for OICs, IAs, and general tax resolution.

- Certified Public Accountants (CPAs): While many CPAs focus on tax preparation and planning, some specialize in tax resolution and can assist with OICs and IAs.

When choosing a professional, look for someone with a strong track record, transparent fees, and good client reviews. Be wary of companies that promise unrealistic results or demand large upfront fees without a clear plan.

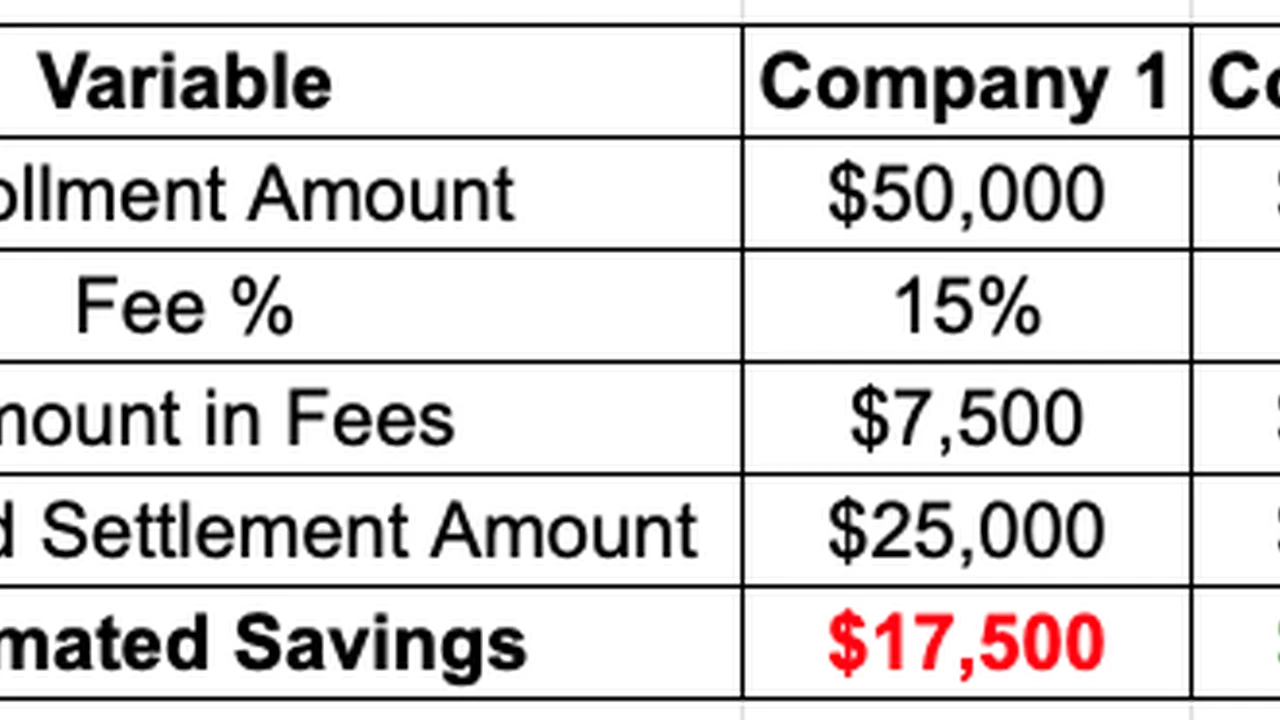

Recommended Tax Debt Relief Products and Services Comparison

While the IRS offers the programs, various companies and software can help you navigate them. Here's a look at some popular options, their typical use cases, and general pricing:

1. Tax Debt Relief Companies Full Service Representation

These companies typically offer end-to-end services, from initial consultation to negotiating with the IRS on your behalf. They often employ a mix of tax attorneys, EAs, and CPAs.

- Use Case: Complex cases, large tax debts, taxpayers who want full representation and minimal direct interaction with the IRS. Ideal for OICs, complex IAs, and penalty abatements.

- Examples:

- Optima Tax Relief: One of the largest and most well-known. Offers a free consultation. Pricing varies widely based on the complexity of the case, typically ranging from $2,000 to $10,000+ for full resolution services. They have a strong focus on OICs and IAs.

- Community Tax: Another highly-rated firm offering similar services. Free consultation. Pricing is also case-dependent, generally in the $1,500 to $8,000+ range. Known for good customer service and a comprehensive approach.

- Jackson Hewitt Tax Resolution: A well-established tax preparation company that also offers tax resolution services. They leverage their network of tax professionals. Pricing can be competitive, often starting around $1,000 for simpler cases and going up for more complex ones.

- Comparison: Optima and Community Tax are often seen as more specialized in resolution, while Jackson Hewitt offers a broader range of tax services. All three provide free consultations, which is a great way to get an initial assessment without commitment.

2. Online Tax Software for Self-Service Installment Agreements

For simpler cases, especially streamlined Installment Agreements, you can often set them up yourself directly with the IRS or use tax software that guides you through the process.

- Use Case: Taxpayers with smaller debts (under $50,000 for individuals, $25,000 for businesses) who are comfortable managing the process themselves. Best for setting up streamlined IAs.

- Examples:

- IRS Online Payment Agreement Tool: This is the official IRS tool. It's free to use and allows you to set up a streamlined IA directly. You'll need your tax information handy.

- TurboTax (with IRS Direct Pay integration): While primarily for tax filing, TurboTax can guide you on how to set up an IA after filing if you owe money. The software itself has various pricing tiers (e.g., Deluxe for $60-$90, Premier for $90-$120), but setting up the IA through the IRS tool is separate and free.

- H&R Block (with IRS Direct Pay integration): Similar to TurboTax, H&R Block's software helps with filing, and then you can use the IRS's free tools for payment plans. Software pricing is comparable to TurboTax.

- Comparison: The IRS tool is the most direct and free. Tax software helps with the initial filing and understanding your liability, but the actual IA setup is still done through the IRS. These are not suitable for OICs or complex non-streamlined IAs.

3. Tax Resolution Software and DIY Kits for OIC Preparation

Some companies offer software or kits designed to help you prepare an OIC application yourself. These are for taxpayers who want to save on professional fees but are willing to put in the significant effort required.

- Use Case: Highly motivated and organized individuals with a good understanding of their finances, who want to attempt an OIC without full professional representation.

- Examples:

- TaxCure (Information and Directory): While not a software, TaxCure offers extensive articles and a directory of tax professionals. It's a great resource for understanding the OIC process and finding local help. Access to information is generally free, but professional services found through their directory will have their own fees.

- Tax Debt Relief DIY Kits (various online vendors): You can find generic 'DIY OIC Kits' online, often priced from $50 to $300. These typically include templates, instructions, and checklists.

- Comparison: DIY kits can be risky. The OIC process is complex, and a small error can lead to rejection. While cheaper upfront, a rejected OIC can cost you more in the long run (lost time, application fees, continued penalties/interest). These are generally not recommended unless you have a very straightforward case and are extremely diligent. Professional guidance is almost always advisable for OICs.

Making the Right Choice for Your Tax Debt Relief Journey

Deciding between an Offer in Compromise and an Installment Agreement, or exploring other options, depends entirely on your unique financial situation. There's no one-size-fits-all answer. Here's a quick decision tree to help you think it through:

- Can you pay your full tax debt within 180 days? If yes, consider a short-term payment plan.

- Can you pay your full tax debt within 72 months (6 years)? If yes, an Installment Agreement (especially a streamlined one if you qualify) is likely your best bet. You can set this up yourself via the IRS website.

- Are you experiencing severe financial hardship and genuinely cannot afford to pay your full tax debt, even over 72 months? If yes, an Offer in Compromise might be appropriate. This is where professional help from a tax attorney or Enrolled Agent becomes highly recommended.

- Are you in extreme hardship and can't even afford minimal payments? You might qualify for Currently Not Collectible status, but remember it's temporary.

Always remember to file all your required tax returns, even if you can't pay. Non-filing penalties are often worse than non-payment penalties, and the IRS won't consider any resolution options until all returns are filed. Don't ignore IRS notices; they won't go away on their own. Taking proactive steps is the best way to resolve your tax debt and get back on track financially.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)