The Importance of Accreditation for Tax Debt Relief Companies

Learn why accreditation matters when choosing a tax debt relief company and what to look for.

The Importance of Accreditation for Tax Debt Relief Companies

Navigating the complex world of tax debt relief can feel like walking through a minefield. There are countless companies out there, all vying for your attention, each claiming to be the best solution for your IRS or state tax problems. But how do you separate the legitimate, trustworthy professionals from the charlatans and scam artists? The answer, in large part, lies in understanding and prioritizing accreditation. Accreditation serves as a powerful indicator of a company's credibility, ethical practices, and commitment to professional standards. It's not just a fancy badge; it's a promise of quality and accountability.

Think of it this way: would you undergo a major medical procedure with a doctor who isn't board-certified? Would you hire a contractor to build your dream home without checking their licenses and references? Probably not. The same logic applies, perhaps even more so, when entrusting your financial future to a tax debt relief company. Your financial health is just as important as your physical health, and choosing the wrong partner can have devastating long-term consequences.

In this comprehensive guide, we're going to dive deep into why accreditation matters, what specific accreditations you should look for, and how these certifications protect you, the consumer. We'll also explore some of the top-tier accredited companies, compare their offerings, and discuss pricing structures so you can make an informed decision. Let's get started on empowering you to choose wisely.

Understanding Tax Debt Relief Accreditation What It Means for You

So, what exactly is accreditation in the context of tax debt relief? At its core, accreditation is a process by which an independent, third-party organization evaluates a company or institution against a set of predetermined standards. For tax debt relief companies, these standards typically cover areas such as ethical business practices, transparency in pricing, client communication, professional qualifications of staff, and adherence to industry best practices. It's essentially a stamp of approval that says, 'This company meets or exceeds recognized benchmarks for quality and integrity.'

For you, the consumer, accreditation offers several crucial benefits:

- Increased Trust and Confidence: Knowing a company is accredited immediately boosts your confidence. It signals that they've voluntarily subjected themselves to external scrutiny and passed.

- Protection Against Scams: Accredited companies are far less likely to engage in fraudulent activities. The accreditation body often has a complaint resolution process, and companies risk losing their accreditation if they don't uphold standards.

- Assurance of Professionalism: Accreditation often requires that staff members hold specific licenses (like CPAs, Enrolled Agents, or tax attorneys) and engage in ongoing professional development.

- Transparency: Accredited companies are generally more upfront about their fees, processes, and realistic outcomes, avoiding the 'too good to be true' promises often associated with scams.

- Quality of Service: While not a guarantee, accreditation often correlates with a higher quality of service, better client communication, and more effective resolution strategies.

It's important to distinguish between accreditation and simple licensing. While licensing (e.g., a law license for an attorney) is a legal requirement to practice, accreditation goes a step further, indicating a commitment to excellence beyond the basic legal minimums. Think of licensing as getting into the game, and accreditation as being recognized as a top player.

Key Accreditation Bodies and What They Represent for Tax Debt Relief Services

When you're researching tax debt relief companies, there are a few key accreditation bodies whose seals of approval carry significant weight. Understanding what each of these represents will help you evaluate a company's credentials more effectively.

Better Business Bureau BBB Accreditation and Ratings

The Better Business Bureau (BBB) is perhaps the most widely recognized and trusted accreditation body for businesses across various industries, including tax debt relief. A company with BBB accreditation (signified by an 'A+' or 'A' rating) means they've committed to the BBB's standards for ethical business practices, including honesty, transparency, responsiveness to customer complaints, and integrity. The BBB evaluates businesses based on factors like complaint history, type of business, time in business, and licensing. While not specific to tax law, a high BBB rating indicates a company's overall commitment to customer satisfaction and ethical conduct.

What to look for: An 'A+' or 'A' rating, a long history of accreditation, and a low number of unresolved complaints.

National Association of Enrolled Agents NAEA and Professional Standards

While not an accreditation body for companies, the National Association of Enrolled Agents (NAEA) is a crucial professional organization for Enrolled Agents (EAs). EAs are tax professionals authorized by the U.S. Department of the Treasury to represent taxpayers before the IRS. NAEA membership signifies that an EA adheres to a strict code of ethics and engages in continuous professional education. If a tax debt relief company employs NAEA members, it speaks volumes about the professional caliber of their staff.

What to look for: Companies that prominently feature NAEA members on their team, indicating a strong foundation in IRS representation.

American Society of Tax Problem Solvers ASTPS and Expertise

The American Society of Tax Problem Solvers (ASTPS) is another important professional organization. It provides specialized training and certification for tax professionals who focus on resolving tax problems with the IRS. While not a company-level accreditation, if a tax debt relief firm has ASTPS-certified professionals on staff, it indicates a deep level of expertise specifically in tax resolution strategies like Offers in Compromise, Installment Agreements, and penalty abatements. This certification is a strong indicator of specialized knowledge in the field.

What to look for: Firms that highlight ASTPS-certified tax professionals, demonstrating specialized expertise in tax problem resolution.

State Bar Associations for Tax Attorneys and Legal Ethics

If a tax debt relief company employs tax attorneys, their membership and good standing with their respective State Bar Associations are paramount. State Bar Associations regulate the legal profession, ensuring attorneys adhere to strict ethical codes, maintain professional competence, and are accountable for their actions. An attorney's good standing with the bar is a fundamental requirement for legal practice and offers a layer of protection for clients, as attorneys are bound by attorney-client privilege and professional conduct rules.

What to look for: Verification that any attorneys on staff are licensed and in good standing with their state bar.

How Accreditation Protects You the Consumer from Tax Debt Scams

The tax debt relief industry, unfortunately, has its share of bad actors. Every year, countless individuals fall victim to scams that promise unrealistic results, charge exorbitant upfront fees, and ultimately leave taxpayers in a worse financial position. This is where accreditation acts as your first line of defense.

Identifying Red Flags and Avoiding Fraudulent Companies

Accreditation helps you filter out the bad apples. Unaccredited companies, or those with poor ratings from reputable bodies like the BBB, often exhibit several red flags:

- Guaranteed Results: No legitimate tax debt relief company can guarantee specific outcomes, as every case is unique and depends on IRS discretion.

- Upfront Fees for Services Not Yet Rendered: While some initial consultation fees are normal, be wary of companies demanding large sums before any work has begun or without a clear scope of services.

- High-Pressure Sales Tactics: Legitimate companies will give you time to consider your options; scammers often push for immediate decisions.

- Lack of Transparency: Vague explanations of their process, hidden fees, or unwillingness to provide credentials are major warning signs.

- Unsolicited Contact: The IRS will never initiate contact via email, text, or social media to demand immediate payment. Be suspicious of companies that reach out to you out of the blue with urgent demands.

Accredited companies, by contrast, are typically transparent about their processes, fees, and the realistic range of outcomes. They operate under a code of ethics that discourages deceptive practices and prioritizes client welfare.

Ensuring Ethical Practices and Transparency in Tax Resolution

Accreditation bodies often require their members to adhere to strict ethical guidelines. For example, the BBB's Standards for Trust include principles like 'Be Transparent,' 'Be Responsive,' and 'Advertise Honestly.' This means accredited companies are expected to:

- Clearly explain their services and fees.

- Provide realistic expectations for resolution.

- Communicate regularly and effectively with clients.

- Address and resolve client complaints promptly and fairly.

- Avoid misleading advertising or false promises.

If an accredited company fails to meet these standards, they risk losing their accreditation, which can severely damage their reputation and business. This provides a powerful incentive for them to maintain high ethical standards, offering you a layer of protection that unaccredited firms simply don't have.

Top Accredited Tax Debt Relief Companies A Comparative Review

Now that we understand the 'why,' let's look at some of the 'who.' Here's a comparative review of some highly accredited and reputable tax debt relief companies, highlighting their strengths, typical services, and general pricing models. Remember, specific pricing will always depend on the complexity of your case.

Optima Tax Relief A BBB Accredited Leader

Optima Tax Relief is one of the largest and most well-known tax debt relief firms in the United States, consistently holding an A+ rating with the Better Business Bureau. They offer a wide range of services, including Offer in Compromise (OIC), Installment Agreements, Penalty Abatement, Wage Garnishment Release, Bank Levy Release, and Audit Representation. Optima employs a team of tax attorneys, Enrolled Agents, and CPAs.

- Accreditations: A+ BBB rating, members of ASTPS, NAEA.

- Services: Comprehensive tax resolution services for individuals and businesses.

- Pricing: Typically involves an initial investigation fee (often $295-$495) to assess your case, followed by a flat fee for resolution services, which can range from $2,000 to $10,000+ depending on complexity. They offer payment plans.

- Pros: Large team of professionals, strong track record, good customer service, transparent pricing.

- Cons: Can be more expensive than smaller firms, some clients report feeling like a number due to their size.

- Best for: Individuals and businesses with significant and complex tax debt who value a well-established, reputable firm.

Community Tax A Highly Rated and Comprehensive Provider

Community Tax also boasts an A+ BBB rating and is known for its comprehensive approach to tax resolution and tax preparation. They offer services similar to Optima, including OICs, Installment Agreements, penalty abatements, and audit defense. They pride themselves on personalized service and a strong focus on client education. Their team includes tax attorneys, CPAs, and Enrolled Agents.

- Accreditations: A+ BBB rating, members of ASTPS, NAEA.

- Services: Tax resolution, tax preparation, and accounting services.

- Pricing: Similar structure to Optima, with an initial investigation fee (around $295-$495) and then a flat fee for resolution, ranging from $1,500 to $8,000+. Payment plans are available.

- Pros: Strong reputation, personalized approach, also offers tax preparation, good communication.

- Cons: Some clients report slower response times during peak tax season.

- Best for: Taxpayers looking for a firm that can handle both resolution and ongoing tax preparation, with a focus on client relationships.

Tax Defense Network A Veteran in Tax Resolution

Tax Defense Network has been in the business for over a decade and maintains an A+ BBB rating. They offer a full suite of tax relief services, including OICs, Installment Agreements, penalty abatements, and assistance with wage garnishments and bank levies. They emphasize a client-centric approach and have a large team of tax professionals. They also offer a free consultation, which is a great starting point for many.

- Accreditations: A+ BBB rating, members of ASTPS, NAEA.

- Services: Comprehensive tax resolution for individuals and businesses.

- Pricing: Free initial consultation. Resolution fees are typically flat-rate, ranging from $1,800 to $9,000+, depending on the complexity and type of resolution. Payment plans are offered.

- Pros: Long-standing reputation, free initial consultation, good customer reviews, transparent process.

- Cons: Some clients report occasional communication delays.

- Best for: Individuals and businesses seeking a well-established firm with a free initial assessment to understand their options.

Jackson Hewitt Tax Resolution Services A Household Name with Tax Expertise

While primarily known for tax preparation, Jackson Hewitt also offers robust tax resolution services, leveraging their extensive network of tax professionals. They hold a strong BBB rating (often A or A+ for their resolution services, though it can vary by franchise location). Their resolution services include help with back taxes, audits, wage garnishments, and OICs. The benefit here is the accessibility of their physical locations for in-person consultations.

- Accreditations: Generally A or A+ BBB rating (check specific location), strong professional network.

- Services: Tax resolution, tax preparation, and other financial services.

- Pricing: Varies more due to franchise model, but typically competitive. Initial consultations may be free or low-cost. Resolution fees can range from $1,000 to $7,000+, depending on the case.

- Pros: Widespread physical locations, trusted brand name, integrated tax preparation services.

- Cons: Service quality can vary slightly by franchise, less specialized than pure tax resolution firms.

- Best for: Taxpayers who prefer in-person service and already use Jackson Hewitt for tax preparation, or those with less complex tax issues.

H&R Block Tax Audit and Tax Debt Services Another Accessible Option

Similar to Jackson Hewitt, H&R Block is a household name in tax preparation that also provides tax audit and debt resolution services. They maintain a good BBB rating (typically A or A+). Their services include audit support, help with IRS notices, and assistance with various tax debt relief options. Their vast network of tax professionals and physical locations makes them highly accessible.

- Accreditations: Generally A or A+ BBB rating (check specific location), large network of tax professionals.

- Services: Tax preparation, audit support, and basic tax debt resolution.

- Pricing: Often competitive, with initial consultations potentially free. Resolution fees can range from $800 to $6,000+, depending on the complexity.

- Pros: Highly accessible, trusted brand, good for straightforward tax debt issues.

- Cons: May not be as specialized for highly complex tax debt cases as dedicated resolution firms.

- Best for: Taxpayers with relatively straightforward tax debt issues or those seeking audit support from a familiar brand.

The Process of Vetting a Tax Debt Relief Company Beyond Accreditation

While accreditation is a fantastic starting point, it's not the only factor to consider. Think of it as the foundation, but you still need to build the rest of the house. Here's how to further vet a tax debt relief company to ensure you're making the best choice for your situation.

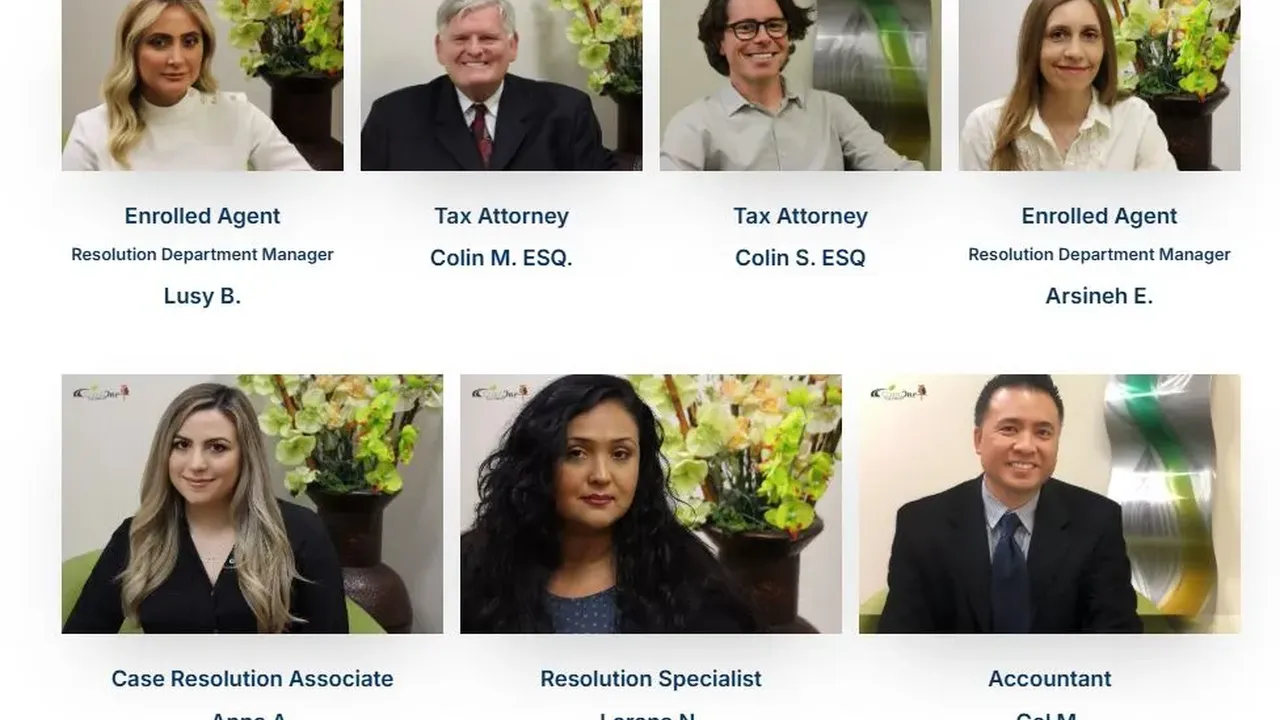

Checking Licenses and Professional Credentials of Staff

Always verify the licenses and credentials of the professionals who will be handling your case. This includes:

- Tax Attorneys: Check their good standing with their respective State Bar Association. Most state bar websites have a searchable database.

- Enrolled Agents (EAs): Verify their status with the IRS's online directory of federal tax preparers.

- Certified Public Accountants (CPAs): Confirm their license with their state's Board of Accountancy.

A reputable company will be transparent about their staff's qualifications and happy to provide this information. If they're evasive, that's a major red flag.

Reading Client Reviews and Testimonials for Real-World Experiences

Beyond the BBB, look at client reviews on independent platforms like Trustpilot, Google Reviews, and Yelp. Pay attention to patterns in reviews:

- Are there consistent complaints about communication, hidden fees, or unrealistic promises?

- Do positive reviews highlight specific aspects like professionalism, successful outcomes, or good customer service?

- Be wary of companies with only five-star reviews and no negative feedback; this can sometimes indicate manipulation.

Remember that even the best companies might have a few negative reviews, but it's the overall sentiment and how they respond to criticism that truly matters.

Understanding Fee Structures and Avoiding Hidden Costs

Before signing any contract, ensure you have a crystal-clear understanding of the company's fee structure. Ask specific questions:

- Is there an upfront investigation fee? What does it cover?

- Is the resolution fee a flat rate or hourly?

- Are there any additional costs for things like IRS transcripts, filing fees, or administrative charges?

- What happens if the resolution takes longer than expected? Does the fee change?

- What is their refund policy if they cannot achieve a resolution?

A reputable company will provide a detailed breakdown of all costs in writing. Be extremely cautious of companies that are vague about fees or pressure you to pay large sums upfront without a clear service agreement.

Asking the Right Questions During Your Initial Consultation

Your initial consultation is your opportunity to interview the company. Come prepared with a list of questions:

- What specific tax debt relief options are available for my situation?

- What are the realistic chances of success for each option?

- Who will be my primary point of contact, and what are their credentials?

- How often will I receive updates on my case?

- What is the estimated timeline for resolution?

- Can you provide references from past clients (if allowed by privacy policies)?

- What is your company's experience with cases similar to mine?

Pay attention to how they answer. Do they listen to your concerns? Do they provide clear, understandable explanations? Do they make you feel comfortable and confident?

The Long-Term Benefits of Choosing an Accredited Tax Debt Relief Partner

Choosing an accredited tax debt relief company isn't just about resolving your current tax problems; it's an investment in your long-term financial health and peace of mind. The benefits extend far beyond the immediate resolution.

Peace of Mind and Reduced Stress During a Difficult Time

Dealing with tax debt is incredibly stressful. Knowing that you've entrusted your case to a reputable, accredited professional can significantly alleviate that burden. You can rest easier knowing that your case is being handled ethically, competently, and with your best interests at heart. This peace of mind is invaluable.

Effective and Sustainable Tax Debt Resolution Strategies

Accredited professionals are more likely to develop effective and sustainable resolution strategies. They understand the nuances of tax law, the various IRS programs, and how to negotiate for the best possible outcome. Their goal isn't just a quick fix, but a solution that genuinely helps you get back on track financially, often preventing future tax issues through proper planning and advice.

Building a Foundation for Future Financial Health and Compliance

Beyond resolving your immediate debt, a good accredited tax debt relief company will often provide guidance on how to avoid future tax problems. This might include advice on proper tax planning, estimated tax payments, record-keeping, and understanding your tax obligations. They help you build a stronger foundation for future financial health and ensure ongoing compliance with tax laws, empowering you to manage your finances more effectively moving forward.

Ultimately, the decision of which tax debt relief company to choose is a deeply personal one. However, by prioritizing accreditation, thoroughly vetting potential partners, and asking the right questions, you significantly increase your chances of a positive outcome. Don't let the stress of tax debt lead you to make a hasty or ill-informed decision. Take the time to research, compare, and choose a partner who is truly committed to helping you achieve lasting tax relief and financial stability. Your future self will thank you for it.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)