What Happens If You Ignore IRS Tax Debt Notices

Understand the serious consequences of ignoring IRS tax debt notices and why prompt action is critical.

Understand the serious consequences of ignoring IRS tax debt notices and why prompt action is critical.

What Happens If You Ignore IRS Tax Debt Notices

Let's face it, receiving mail from the IRS can be intimidating. That sinking feeling in your stomach when you see that official envelope is something many taxpayers dread. But what happens if you decide to just… ignore it? You might think that if you don't open it, or if you just toss it in a pile, the problem will magically disappear. Unfortunately, that's not how the IRS operates. Ignoring IRS tax debt notices is one of the worst things you can do for your financial health. It doesn't make the debt go away; it only makes it worse, leading to a cascade of increasingly severe penalties and enforcement actions. This article will walk you through the typical progression of events when you ignore IRS notices, the potential consequences, and most importantly, what you should do instead.

The Initial Stages of IRS Communication Understanding IRS Notices and Letters

The IRS doesn't just jump straight to aggressive enforcement. They typically start with a series of notices and letters, each designed to inform you of your tax obligation and encourage you to take action. These aren't just random pieces of mail; they follow a specific sequence and carry increasing weight.

CP14 Notice Your First Warning for Unpaid Taxes

Often, the first notice you'll receive is a CP14. This is a bill for unpaid taxes, penalties, and interest. It's usually a straightforward statement indicating the amount you owe and the due date. It's a gentle reminder, but don't underestimate its importance. Ignoring a CP14 means you're ignoring the initial opportunity to address the debt before it escalates.

CP501 CP503 and CP504 Notices Escalating Demands for Payment

If you ignore the CP14, the IRS will send follow-up notices like the CP501, CP503, and CP504. These notices become progressively more urgent. The CP504, in particular, is a serious warning. It states the IRS's intent to levy (seize) your state tax refund and potentially other assets if you don't pay. This is a clear signal that the IRS is preparing to take more aggressive collection actions.

Letter 11 Wage Levy and Bank Levy Intent

Following the CP504, you might receive Letter 11, which is a Final Notice of Intent to Levy and Notice of Your Right to a Hearing. This is a critical notice because it informs you that the IRS plans to seize your wages, bank accounts, or other property. It also provides you with the right to request a Collection Due Process (CDP) hearing, which is your last chance to dispute the debt or propose an alternative resolution before a levy occurs. Ignoring this letter means you forfeit your right to this hearing, making it much harder to stop a levy once it's initiated.

The Escalation of Enforcement Actions What Happens When You Keep Ignoring

If you continue to ignore these notices, the IRS will move beyond warnings and begin taking concrete steps to collect the debt. These actions can have significant and long-lasting impacts on your financial life.

IRS Tax Liens Your Credit Score and Asset Security

One of the first major actions the IRS can take is filing a Notice of Federal Tax Lien. A tax lien is a legal claim against your property, including real estate, personal property, and financial assets. It publicly announces that you owe the government money and can severely damage your credit score. A tax lien makes it incredibly difficult to sell property, refinance a mortgage, or even obtain new credit. It essentially ties up your assets until the debt is paid. For example, if you own a home, a tax lien means you can't sell it without the IRS getting paid first from the proceeds. This can be a huge obstacle if you need to relocate or access your home equity.

IRS Tax Levies Seizing Your Wages Bank Accounts and Property

A levy is even more aggressive than a lien. While a lien is a claim against your property, a levy is the actual seizure of your property to satisfy the debt. The IRS can levy your wages, bank accounts, retirement accounts, and even physical property like cars or real estate. A wage levy means a portion of your paycheck will be sent directly to the IRS before you even see it. A bank levy means the IRS can seize funds directly from your bank account. This can leave you without access to essential funds for living expenses, rent, or mortgage payments. Imagine waking up to find your bank account empty – that's the reality of an IRS bank levy. The IRS doesn't need a court order to do this; their administrative powers allow them to act directly.

Passport Revocation International Travel Restrictions

For taxpayers with seriously delinquent tax debt (currently defined as over $59,000, adjusted for inflation), the IRS can notify the State Department to revoke, deny, or limit your passport. This can be a devastating consequence, especially for those who travel for work, family, or leisure. If you're an expat or frequently travel to Southeast Asia for business or personal reasons, losing your passport can completely disrupt your life and livelihood. This is a relatively newer enforcement tool, but it's a powerful one that can severely restrict your freedom of movement.

Penalties and Interest The Ever-Growing Debt Burden

Every day you ignore your tax debt, it grows. The IRS charges penalties for failure to pay, failure to file, and accuracy-related issues. On top of these penalties, interest accrues on both the unpaid tax and the penalties. This means your debt can quickly spiral out of control, making it even harder to pay off in the long run. The failure-to-pay penalty is 0.5% of the unpaid taxes for each month or part of a month that taxes remain unpaid, up to a maximum of 25% of your unpaid tax. Interest rates are set quarterly and can fluctuate, but they consistently add to your burden.

Criminal Prosecution Rare but Possible for Extreme Cases

While rare, in extreme cases of intentional tax evasion or fraud, ignoring IRS notices can contribute to a criminal prosecution. This typically involves significant amounts of undeclared income, fraudulent returns, or deliberate attempts to conceal assets. While most tax debt cases are civil matters, a pattern of ignoring notices and actively attempting to evade taxes can elevate the situation to a criminal investigation, leading to severe fines and even imprisonment.

Why People Ignore IRS Notices Common Reasons and Misconceptions

Understanding why people ignore these notices can help shed light on the problem. It's rarely out of malice, but often due to fear, misunderstanding, or feeling overwhelmed.

Fear and Anxiety The Paralysis of the Unknown

Many people are simply afraid of the IRS. The thought of dealing with a government agency, especially one that can seize your assets, can be paralyzing. This fear often leads to avoidance, where people hope the problem will just go away if they don't acknowledge it. This is a natural human response to stress, but it's counterproductive when dealing with the IRS.

Lack of Understanding Complex Tax Laws and Jargon

Tax laws are incredibly complex, and IRS notices are often filled with jargon that can be difficult for the average person to understand. If you don't comprehend what the notice is asking for or what the consequences are, it's easy to feel overwhelmed and simply put it aside. This is where professional help becomes invaluable.

Financial Hardship No Money to Pay

Sometimes, people ignore notices because they genuinely don't have the money to pay the tax debt. They might feel that responding will only lead to demands they can't meet, so they avoid the confrontation. However, the IRS has programs specifically designed for taxpayers experiencing financial hardship, which can only be accessed by communicating with them.

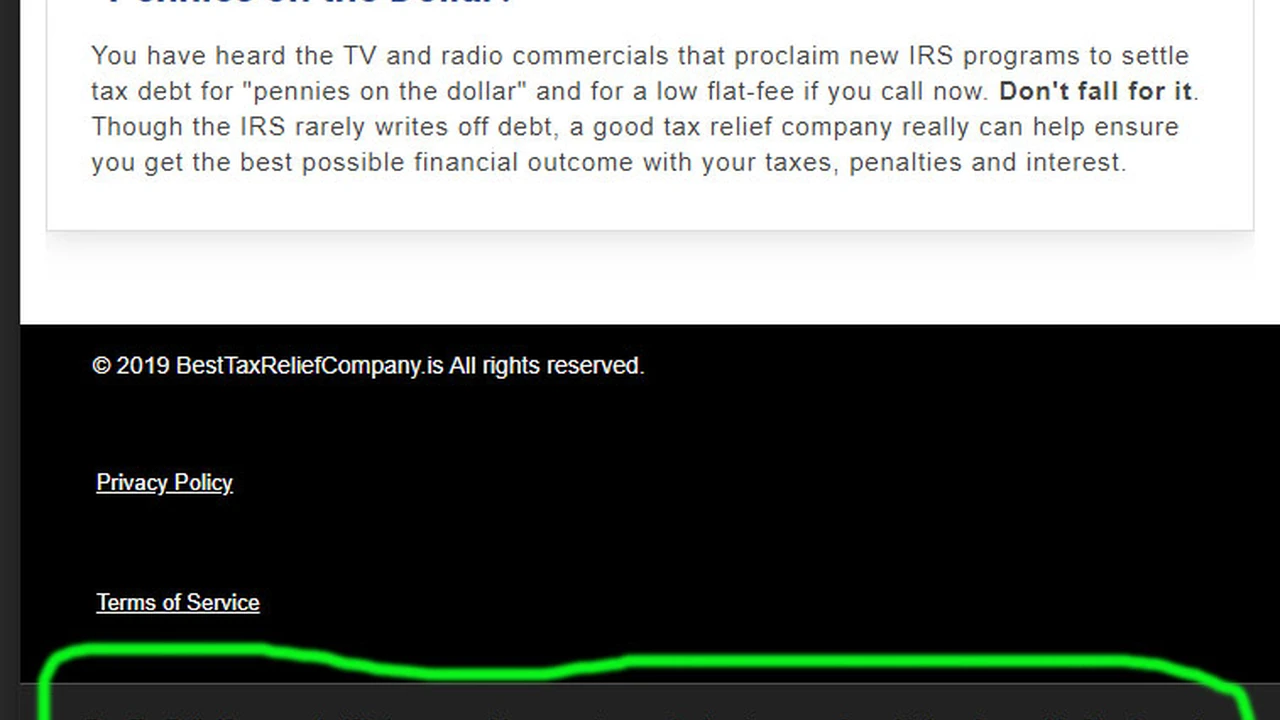

Belief in Scams Distinguishing Real IRS Mail from Fraud

With the rise of tax scams, some people might mistakenly believe that legitimate IRS notices are fraudulent. While it's crucial to be vigilant against scams, it's equally important to know how to identify genuine IRS correspondence. The IRS typically initiates contact via mail, not phone calls or emails, especially for initial debt notifications.

What You Should Do Instead Proactive Steps to Resolve Tax Debt

The absolute best course of action is to never ignore an IRS notice. Open it, read it, and take action. Here's what you should do:

1. Open and Read Every Notice Immediately

Don't let fear win. Open every piece of mail from the IRS as soon as you receive it. Understand what it's asking for and the deadline for response. The sooner you act, the more options you'll have.

2. Verify the Notice's Authenticity

If you're unsure whether a notice is legitimate, don't call the number on the notice itself, as it could be a scammer. Instead, go to the official IRS website (IRS.gov) and find their official contact numbers. You can also log into your IRS online account to view your tax records and see if the notice is reflected there.

3. Understand Your Options IRS Tax Debt Relief Programs

The IRS offers several programs to help taxpayers resolve their tax debt. These include:

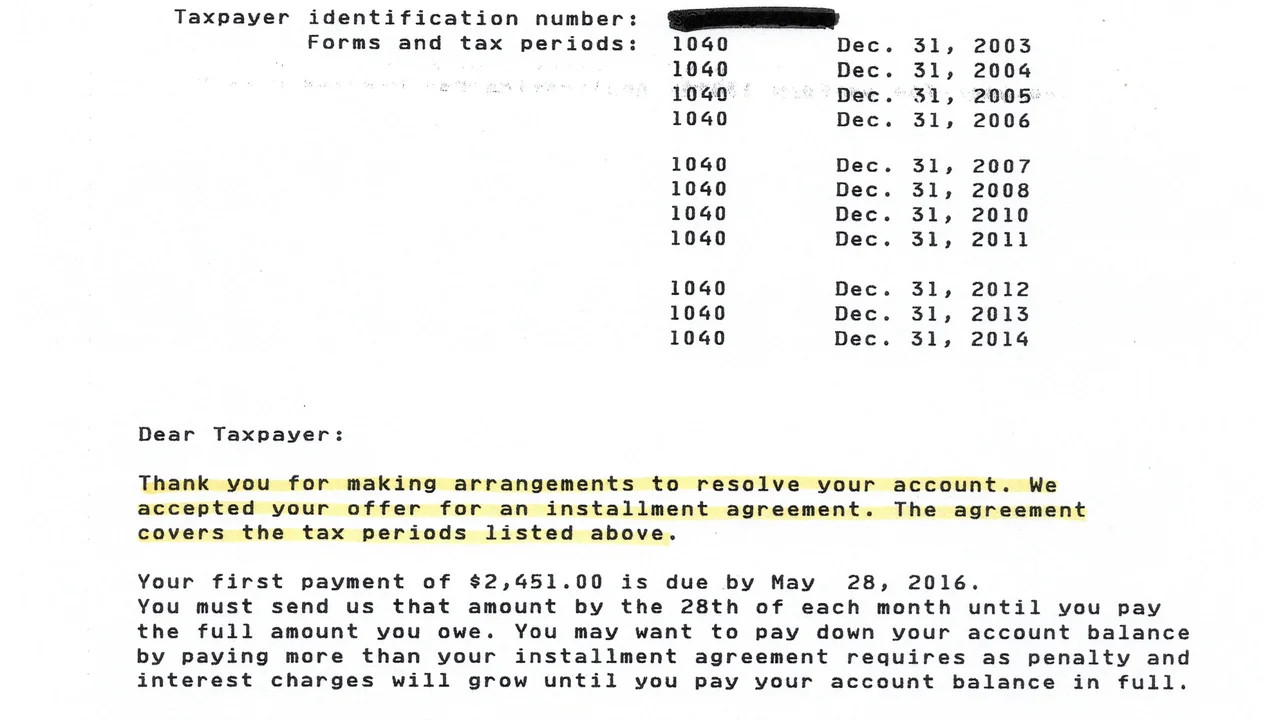

- Installment Agreement (IA): This allows you to make monthly payments over a period of up to 72 months. It's a good option if you can pay off your debt within that timeframe.

- Offer in Compromise (OIC): An OIC allows certain taxpayers to resolve their tax liability with the IRS for a lower amount than what they originally owe. This is typically granted when paying the full amount would cause significant financial hardship.

- Currently Not Collectible (CNC) Status: If you can demonstrate that you cannot pay your basic living expenses and your tax debt, the IRS may place your account in CNC status. This temporarily pauses collection efforts, though interest and penalties continue to accrue.

- Penalty Abatement: In certain circumstances, the IRS may remove or reduce penalties if you can show reasonable cause for not meeting your tax obligations.

4. Contact the IRS or a Tax Professional

If you owe money, contact the IRS directly or, even better, seek help from a qualified tax professional. They can help you understand your options, negotiate with the IRS on your behalf, and ensure you choose the best path forward. Tax professionals include:

- Enrolled Agents (EAs): Federally licensed tax practitioners who specialize in taxation and have unlimited practice rights before the IRS. They can represent taxpayers on all tax matters.

- CPAs (Certified Public Accountants): State-licensed accounting professionals who can also represent taxpayers before the IRS, though their primary focus is often broader accounting services.

- Tax Attorneys: Lawyers specializing in tax law who can represent taxpayers in complex cases, including tax court.

Many tax relief companies employ a combination of these professionals. When choosing a professional, look for those with a strong track record, transparent fees, and positive client reviews. Avoid companies that make unrealistic promises or pressure you into signing contracts immediately.

Recommended Products and Services for Tax Debt Resolution

While the IRS offers direct programs, many taxpayers find it beneficial to work with third-party services or utilize specific tools. Here are some categories and examples:

Tax Resolution Firms Professional Negotiation and Representation

These firms specialize in representing taxpayers before the IRS. They can help you navigate the complexities of OICs, IAs, and other relief programs. They often have experienced EAs, CPAs, and tax attorneys on staff.

- Optima Tax Relief: One of the largest and most well-known tax relief companies. They offer a wide range of services, including OICs, IAs, penalty abatement, and audit defense. They have a strong online presence and generally positive reviews, though like all large firms, some complaints exist. Their fees can vary significantly based on the complexity of the case, often starting from a few thousand dollars for simpler cases and going up for more involved situations. They are known for their comprehensive approach and dedicated case managers.

- Community Tax: Another highly-rated firm offering similar services to Optima. They emphasize personalized service and have a good reputation for customer support. They also handle state tax issues, which is a significant advantage. Pricing is typically competitive with other major firms, with initial consultations often being free. They are particularly strong in helping clients understand their options and setting realistic expectations.

- Tax Defense Network: This firm focuses on providing affordable tax relief solutions. They offer a free consultation and work with clients to find the best resolution strategy. They are known for their transparent pricing and commitment to client education. Their services range from basic tax preparation to complex tax resolution, with fees structured to be accessible.

Comparison: Optima and Community Tax are generally seen as more comprehensive, often handling larger or more complex cases. Tax Defense Network might be a good starting point for those with less severe debt or who are looking for more budget-friendly options. All three offer free consultations, which is a great way to compare their approaches and pricing without commitment.

Tax Software for Accurate Filing and Prevention

While not directly for debt resolution, using reliable tax software can prevent future debt by ensuring accurate filing. Many also offer audit support.

- TurboTax: The market leader, known for its user-friendly interface and step-by-step guidance. It's excellent for preventing errors that could lead to debt. They offer various versions, from free (for simple returns) to premium (for self-employed or complex investments), with prices ranging from $0 to over $100 for federal filing, plus state filing fees. Their audit support feature can be helpful if you receive an IRS notice after filing.

- H&R Block Tax Software: A strong competitor to TurboTax, offering similar features and ease of use. They also have physical locations for in-person assistance, which can be a comfort for some taxpayers. Pricing is comparable to TurboTax, with various tiers available. Their tax pros can review your return for an additional fee, adding an extra layer of security.

- TaxAct: Often a more budget-friendly option compared to TurboTax and H&R Block, while still offering robust features. It's a good choice for those who want to save money on filing fees without sacrificing too much functionality. Pricing is generally lower across all tiers, making it attractive for cost-conscious filers.

Comparison: TurboTax and H&R Block offer the most polished user experience and extensive support, making them ideal for those who want maximum hand-holding. TaxAct provides a solid, more affordable alternative. All three are excellent for ensuring accurate tax preparation, which is the first line of defense against future tax debt.

Financial Planning and Budgeting Tools for Long-Term Prevention

These tools help you manage your finances proactively, reducing the likelihood of accumulating tax debt.

- You Need A Budget (YNAB): A popular budgeting app that emphasizes giving every dollar a job. It's highly effective for gaining control over your spending and ensuring you set aside money for taxes, especially if you're self-employed. YNAB costs around $14.99 per month or $99 per year, but many users find the investment pays for itself many times over in financial clarity and savings.

- Mint: A free budgeting and financial tracking app from Intuit (makers of TurboTax). It allows you to link all your accounts, track spending, create budgets, and monitor your credit score. While it doesn't have the same 'envelope' budgeting philosophy as YNAB, it's a powerful tool for getting an overview of your financial health and identifying areas where you can save for tax obligations.

- Personal Capital (now Empower Personal Wealth): Offers free financial tracking tools similar to Mint, but also provides more in-depth investment analysis and retirement planning features. They also offer paid financial advisory services. The free tools are excellent for understanding your net worth and investment performance, which indirectly helps in tax planning.

Comparison: YNAB is best for those who want a strict, proactive budgeting system. Mint is great for a free, comprehensive overview of your finances. Personal Capital is ideal for those who want to integrate investment tracking with their budgeting. All three can help you build financial discipline to prevent tax debt.

The Importance of Timely Action and Professional Guidance

The overarching message is clear: ignoring IRS tax debt notices is a recipe for disaster. The IRS has significant power to collect unpaid taxes, and they will use it if you don't engage with them. The penalties and interest will continue to accrue, your credit will be damaged, and your assets could be seized. By taking prompt action, understanding your options, and seeking professional help when needed, you can navigate your tax debt effectively and avoid the most severe consequences. Don't let fear or confusion paralyze you. There are solutions available, but they require you to take the first step and respond to those notices.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)